Student Loan Debt Crisis

A college degree is often considered a must-have in the job market. However, getting one is expensive, so much so that millions of people today are burdened with student loan debt crisis. It is an awful weight to carry so early in life.

The situation of Student Debt Loan at Present

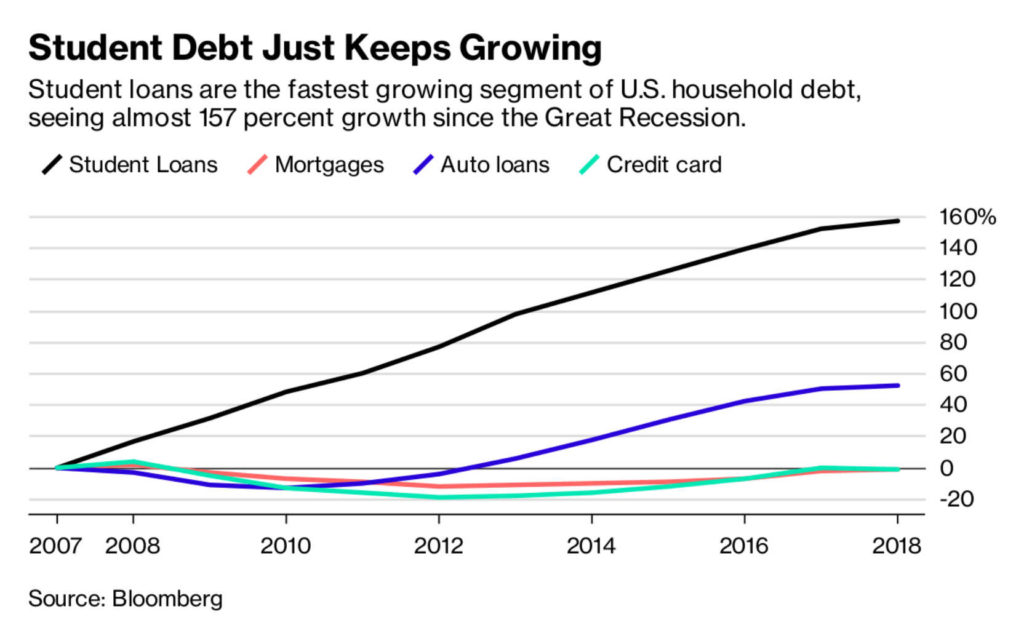

With each passing year, student loan debt is mounting to higher numbers. According to Forbes, student loan debt in 2020 is now about $ 1.56 trillion in the US, the highest it has ever been. Student loan debt is the second-highest consumer debt category next to the mortgage.

Here’s an overview of student loan statistics according to a report by Forbes Magazine as of 4Q, 2018 in the US:

Total Student Loan Debt: $1.56 trillion

Total US Borrowers Beside Student Loan Debt: 44.7 million

Student Loan Delinquency Or Default Rate: 11.4% (90+ days delinquent)…..

Direct Loans-Cumulative in Default (360+ days delinquent): $101.4 billion (5.1 million borrowers)

Debt Loan In Forbearance: $111.1 billion (2.6 borrowers)

Other essential statistics from the same report:

- Approximately seven in 10 seniors (68%) who graduated from public and non-profit institutes in 2015 had student loan debt.

- Public Colleges: 66% of borrowers who graduated from public colleges have student loan debt. The average student loan debt at public colleges is $25,550, which is 25% higher than that was in 2008.

- Private Non-Profit Colleges: 75% of borrowers who graduated from private non-profit colleges have student loan debt. The average student loan debt at private non-profit institutes is $32,300, which is 15% higher than it was in 2008.

- For-Profit Colleges: 88% of borrowers who graduated from for-profit colleges have student loan debt. Average student loan debt at for-profit colleges is $39,950, which is 26% higher than it was in 2008

Why Student Loan Debt Crisis Matters

Student loan debt is an essential concern to both graduates and government as a student loan debt crisis can determine how an economy and society takes shape as a whole.

Considering how expensive tuition fees are and the increase in the number of student loan borrowers. There is a threat of more students dropping out of college, defaulting on the debt, or not choosing to apply for higher education at all.

According to a report by Yale University, economies will struggle under the growing mound of student debt as young adults delay marriage. Home purchases, and childbirth and have less money to spend on housing, food, clothes, or entertainment.

As a consequence, the government can expect to confront a dilemma concerning increasing defaults on government-sponsored student loans: enforced repayment versus measured forgiveness. Likewise, students, especially those with limited resources, struggle over whether to borrow, delay, or forgo higher education.

That implies student loan debt has a pivotal role in the borrower’s financial choices and status throughout their life.

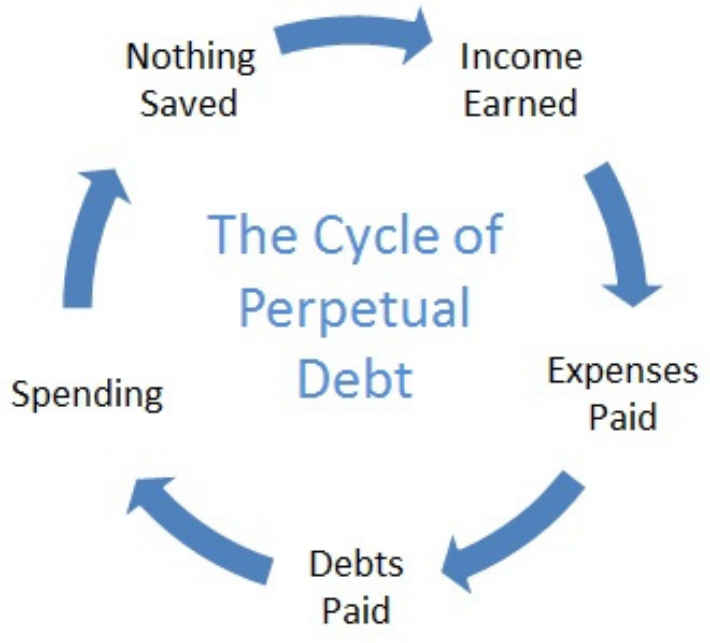

When viewing these younger generations with heaps of student loans from a macroeconomic perspective, the economy has an entire segment trapped in a debt crisis. Here’s how the life of student loan borrowers looks. A borrower, while working to make ends meet, has to segregate a portion of his/her earning to debt installment payment along with interest. That means nothing saved at the end of the day. The consequence of this pattern in the economy is a slowdown in economic growth.

Seth Frontman, Executive Director of Student Borrower Protection Centre, said in an interview with CBSN, “As a society, we don’t understand the true impact that this debt is having not only on the individual household but also on the larger society. Student debt impacts people’s ability to buy a house, save for retirement, what career they can enter.

People with student loans make less throughout their lives; they can’t get to the careers they want. Where this gets scary is we’re starting to see how student debt is driving income inequality, racial inequality. Because we are creating the haves and the have nots in American society. That is filled out by those who are forced to take on student debt to get an advance through.”

That affects the borrowers’ life for decades, which is a terrible thing. For a government, there is a risk of default on the government’s student loan program in the short term and slow economic growth in the long run.

Underlying Causes of Student Loan Debt Crisis

Rising Tuition Fees: In the US, colleges charge at least $50.000 on average for tuition. The immediate cause of such a spike is because of the rise in demand for higher education. The number of people applying for going to colleges has increased. However, there has been no proportional increase in the number of colleges. So as a pure-play of demand and supply, the tuition fee has increased over the years.

Another reason for an increase is colleges started building infrastructure and amenities to attract students to have a good source of finance. The rationale behind this is the rich segment of students could easily afford the fees while also had a chance of having a bright career. However, even the middle-income group of students started applying to these kinds of colleges due to easy access to a loan.

Easy Access to Finance:

The availability of loans made it look like the benefits overweighs the actual cost of higher education, with no realization of how much it is going to cost over the years with an increasing rate of interest. In the US, the Student Loan Marketing Association acts as a facilitator for students to get loans that is easy and safe.

The standard loan contract allows anyone who cannot pay to put off payment for years. Still, the amount owed rises in the meantime as the deferred interest is added to the total bill. What’s more dangerous is, some borrowers do not know what they are signing up for.

Beth Hansen, a student loan borrower, expresses her struggle in an interview with PBS NewsHour, “Think, how old was I when I first signed my first promissory note? Seventeen. Am I going to read the said promissory note from beginning to end? Or even understand even if I had read it. “

Student Loan Debt amid Coronavirus Pandemic

The coronavirus pandemic is going to have a ripple effect on significant aspects of the economy. A global recession is underway, and millions of people have lost their job amid the crisis.

In the middle of this time of economic hurdles, the US Department of Education said that the student loan borrowers don’t have to pay until October.

In the UK, students have signed a petition demanding tuition fee refunds for university rent and tuition.

However, there have been no significant reliefs granted by private lenders.

Tips on Dealing with student debt crisis

- Know what you are signing up for: It is necessary to understand what the student loan contract says. There are two types of student loans; subsidized loans and unsubsidized loans. Subsidized loans are for those who can have justification financial needs. It is a need-based loan. An unsubsidized loan is a not need-based loan.

- Get Organized: You need to have a clear idea about your earning and where and how much you spend it. While balancing between paying for basic requirements like rent, utilities, and textbooks, and fun things, you might lose track of how much you are spending on what. Visualizing your expenses can help you keep on track and have control over your expenses. Make a budget on your income and expenses and stick to you.

- Cut Spending: In your budget, look for heading; you can cut down your expenses. This way, you can build up your savings. Living a minimalist lifestyle for a few years can guarantee a life of financial freedom for the rest of your life.

- Start from now: While you are in college, you might feel like there is no urgency to start paying off your debt, but acting right now is the smartest option. It will save you from tons of hassles later as interest keeps increasing. Buying that dress, going on that trip, or buying a new phone might seem like a much fun idea for now, but trust me, you will thank yourself later if you choose to spend your money on your debt instead.

- Make more money: Now this is obvious but an important one. Taking up multiple jobs at a time so that you are meeting up your basic requirement while also sparing some amount to pay off your debt.

The student loan debt crisis is a much bigger problem for an individual, economy, and society as a whole. The student loan debt can have a long-lasting impact on borrower’s life for decades in personal expenses, buying a house, marriage, and even the career they pursue.

The bigger picture of this is an entire segment of a young generation trapped in a debt cycle, which ultimately slows down economic growth. While borrowers themselves need to be careful about taking up the loan and paying off the debt government and colleges also need to come up with better programs to break the cycle and bring a change.